Tridhya Tech Ltd public issue subscribes over 72 times; Receives overwhelming response from Retail Investors

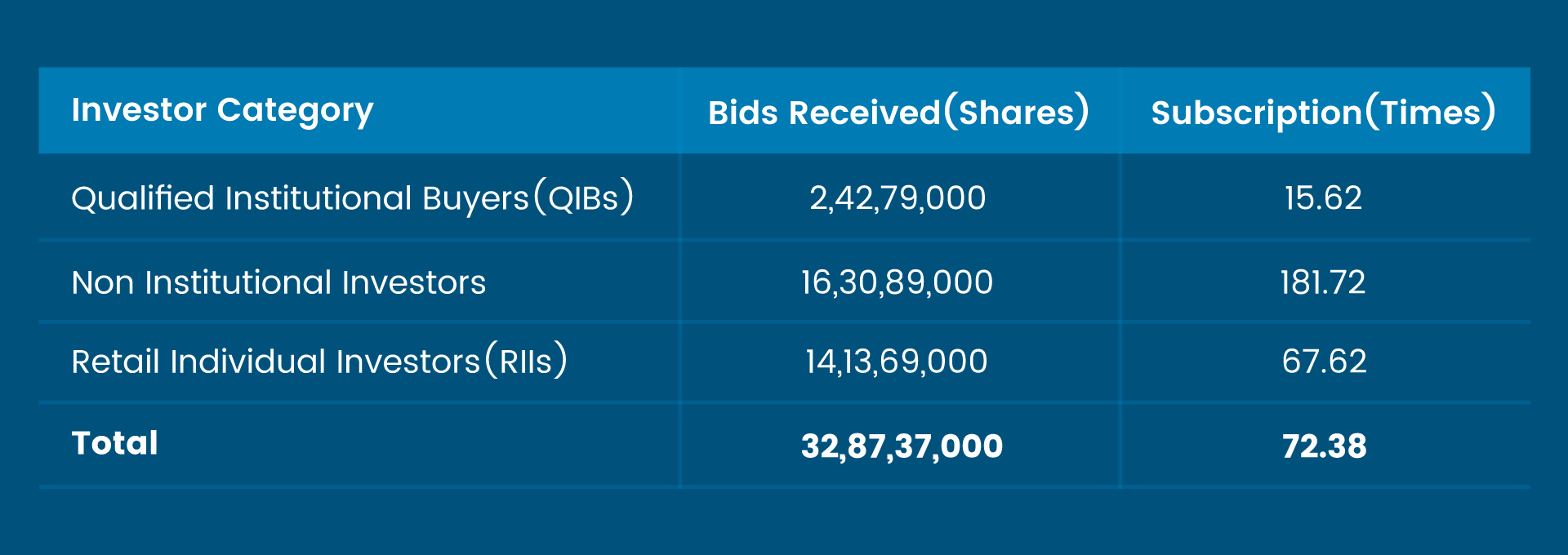

The initial public offering of an Ahmedabad-based software development company, Tridhya Tech Ltd received an overwhelming response for its Rs. 26.41 crore SME IPO and got subscribed over 72 times. Non-institutional investor category received the highest interest among investors and was subscribed over 182.72 times. The retail segment was subscribed 67.62 times and the QIB segment was subscribed 15.62 times. The company received bids for 32.87 crore shares against the 62.88 lakh shares on offer in the public issue.

The company has finalised the issue price at Rs. 42 per share. The company’s shares will be listed on the SME Emerge Platform of the National Stock Exchange on July 13, 2023. The public issue closed for subscription on July 5. The company plans to use the proceeds of the public issue for the repayment of unsecured and secured loans and general corporate purposes for the company’s business activities. Interactive Financial Services Ltd is the lead manager of the issue.

Mr. Ramesh Marand, Managing Director, “We want to thank all the investors for their trust and confidence in the company and its management. We are confident that with the support of all the stakeholders, we will be able to execute our growth strategy in a manner that creates exponential value for all stakeholders.”

The IPO Committee of the company at its meeting held on June 27, 2023, in consultation with the book running lead managers to the offer finalized allocation of 14.31 lakh equity shares to anchor investors at an offer price of Rs. 42 per share raising Rs. 6.01 crore. The company has allocated 9.54 lakh equity shares to Craft Emerging Market Fund – Elite Capital Fund and 4.77 lakh equity shares to Craft Emerging Market Fund – Citadel Capital Fund.

**Market Maker portion is not included in NII/HNI.

Incorporated in 2018, Tridhya Tech Limited is an Ahmedabad-based full-service software development company that believes in technological empowerment and caters its services to eCommerce, web, and mobile application development and provides end-to-end tech solutions to build an effective digital presence.

The financial performance of the company has exhibited remarkable progress over the years, demonstrating substantial growth and stability. For the nine months ended December 2022, the company reported total revenue of Rs. 15.08 crore and earned a net profit of Rs. 2.85 crore. As on December 2022, the Net worth of the company stands at Rs. 20.30 crore, Total Assets at Rs. 59.69 crore, and Reserves & Surplus at Rs. 18.60 crore. Promoter Group’s shareholding pre-issue is 80.8% which post-issue will be 58.98%.

Recent News

-

Tridhya Tech Limited Secures Two Long-Term International Contracts for Software Development

-

Company Announcement: Securing Major Contract with Liferay India for INR 2 CR plus

-

Silwatech: Tridhyatech’s Innovative Branch and Venture

-

Software Development Firm Tridhya Tech lists on NSE Emerge

-

Tridhya Tech Ltd public issue subscribes over 72 times; Receives overwhelming response from Retail Investors